How To Increase Reimbursements & Upfront Collections

The Challenge

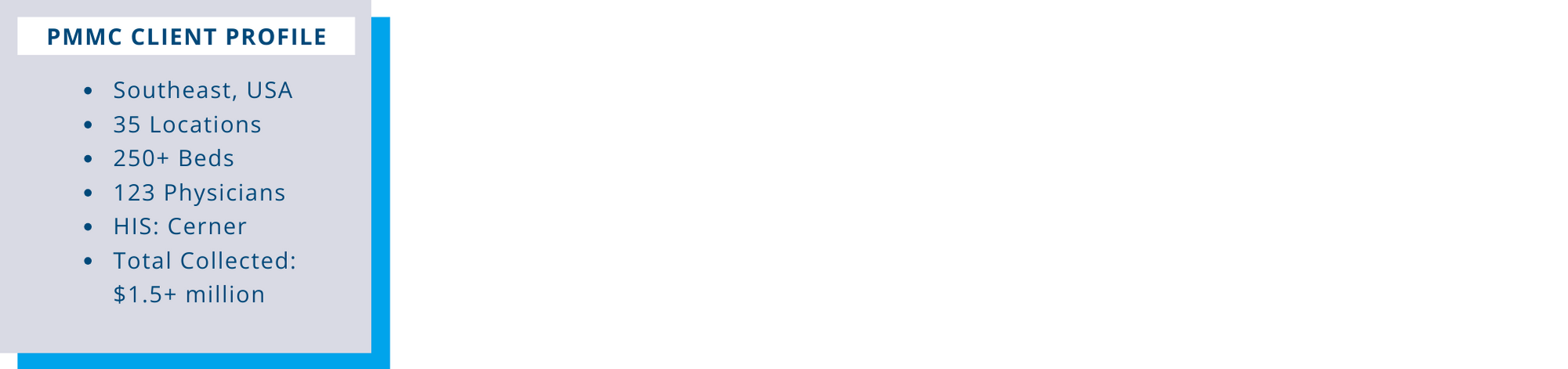

A medical center in central Tennessee identified opportunities to collect underpayments from its contracted payers and improve point-of-service collections. They had three main goals.

The first goal was to identify, validate and collect contractual underpayments through an automated process. Second was to monitor the overall performance of its payer contracts and negotiate improved reimbursement. Lastly, was to verify insurance and benefit coverage before the point-of-service and increase patient collections and satisfaction by addressing the growth of self-pay patients and high-deductible health plans

The Solution

Through process improvement changes and providing new tools to its staff to properly perform their jobs, the medical center created an integrated process to accomplish two tasks. First was calculating the contractual expected reimbursement for underpayment collections with PMMC’s calculation engine. From there, they would leverage the data for generating patient estimates. After payment posting, they can now track payer performance and recover underpayments from the primary insurance company.

Prior to the patient’s service being provided, these improvements allow the medical center to accurately calculate the patient financial responsibility based on the latest eligibility data as well as the primary payer’s negotiated rates and terms increasing point-of-service collections.

With contractual adjustments growing and net revenue remaining flat, the medical center finance team suspected there were opportunities to improve their managed care and commercial reimbursement. They also identified the need for a contract management system to support prospective contract modeling as well as auditing the anticipated contract terms that were becoming more intricate.

Their Contract Compliance Analyst notes, “After implementing process changes and a new contract management system we immediately began uncovering contractual underpayments as well as billing, coding and registration process changes that generated tangible results.”

From there they implemented a more pro-active approach to financial counseling. In an effort to maximize their collections, the registration process was assessed to determine how patient collections could accurately be performed on the front end.

Within four weeks of choosing a partner for generating patient estimates, it was fully implemented and in use. The estimates enabled the staff to easily determine and communicate the patient’s estimated bill and payable portion, using the insurance plan for calculating the estimated contractual allowance along with the patient co-pay, co-insurance and remaining deductible. It also allows for financial arrangements to be included on the patient form.

The Results

As it relates to contract management services, the medical center has successfully renegotiated several payer contracts and has implemented an improved contractual underpayment identification and collection process.

While great strides were made with process improvement and patient education, since implementing a patient estimation solution, in the first two years they experienced approximately a 1000% increase in point of service collections over the baseline from improved patient communications. This translated into a 13% growth in total patient cash collections and a nearly 650% ROI in the first year alone.

“Patient Access now has a more proactive role in cash collections and the revenue cycle. Two years ago, 5% of our patient collections were at the time of service. Through process changes we increased this to 12-15%. By incorporating PMMC’s patient estimation system, we have seen this increase to 22-26% each month,” said the medical center’s Director of Patient Access.

An additional positive outcome has been the ability to resolve issues and misunderstandings at the source. Providing patients with an accurate estimate of their financial responsibility prior to performing services has also improved our patient satisfaction scores. On a survey administered to the patients, 52% of respondents said they had an excellent experience, a 9.1% increase from previous years.